tax avoidance vs tax evasion examples

In the fiscal year 2019 the IRS completed 1183 legal-source tax case investigations with 663 referred for prosecution. To assess your answers click the Check My Answers button at the bottom of the page.

Tax Evasion Vs Tax Avoidance Dsj Cpa

Youve seen the examples of tax evasion and tax avoidance above.

. Keeping a tip log B. Declaring insolvency and restarting business under a different name. For example if someone transfers assets to prevent the IRS from determining their actual tax liability there is an attempted to evade assessment.

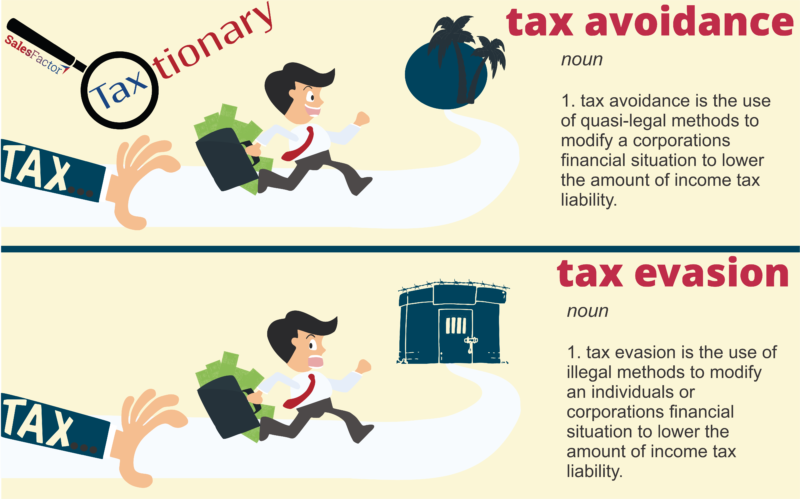

Tax evasion on the other hand is using illegal means to. And this was the reason why Vijay Malia was. Tax evasion is finding a way to avoid covering tax such as not announcing salary to the taxman.

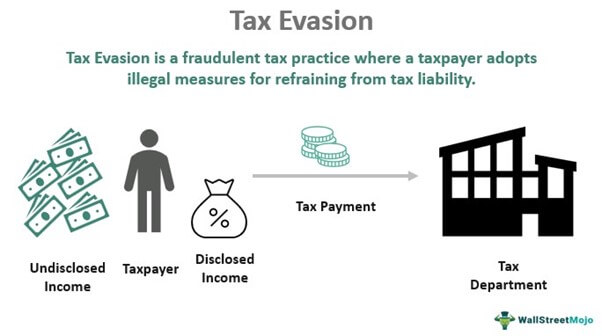

What is tax evasion. Ignoring earnings for pet-sitting D. Because his earnings from gambling and alcohol were not submitted to the tax department it was considered as tax avoidance and the disparity.

Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits. 2 Banking on Bitcoin. The IRS will deduct expenses for non-reimbursed business expenses.

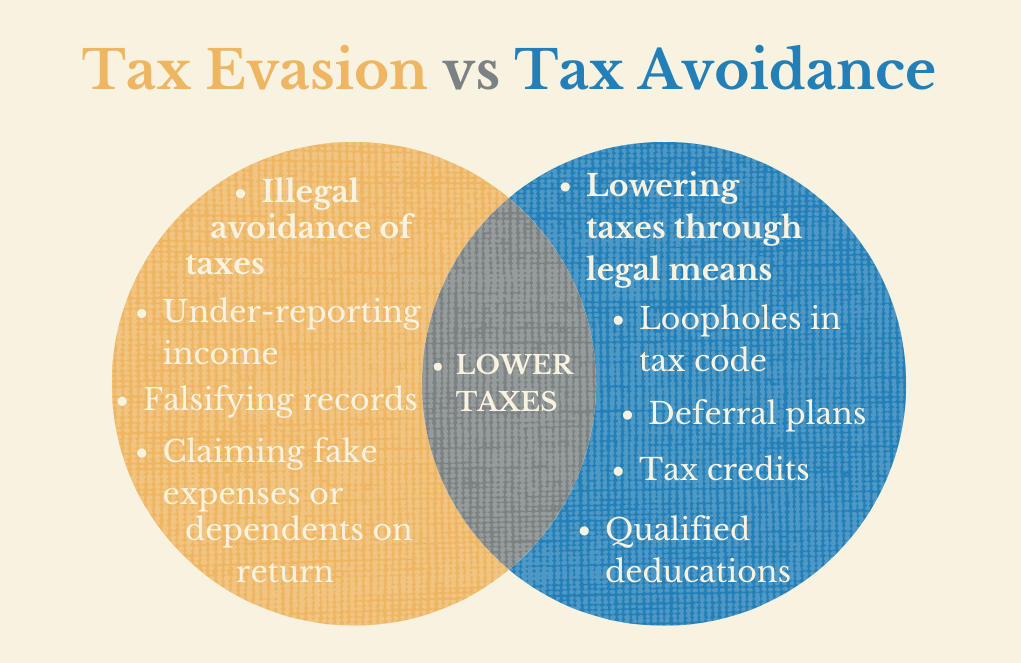

Tax avoidance involves using legal means to reduce the entire amount of money you will send to the IRS every year. Moreover one of the common examples of tax avoidance to minimize a taxable income is when a homeowner receives a tax deduction from their home mortgage although tax rules have drastically changed over the years. Hence check the details below to get to know about tax evasion vs tax avoidance.

Deductions are a great way to reduce your taxable income. 1 Keeping a log of business expenses. Tax avoidance means using the legal means available to you to reduce your tax burden.

If you or a loved one has been accused of tax evasion. What is Tax Avoidance. When you avoid tax payment via illegal means it is called tax evasion.

In legitimate terms there is a significant. Take advantage of each deduction. In addition providing tax deductions for.

What is the Difference. If income is not reported by someone authorities do not possess a tax claim on them. The IRS has rules about cryptocurrencies and their transactions are taxable.

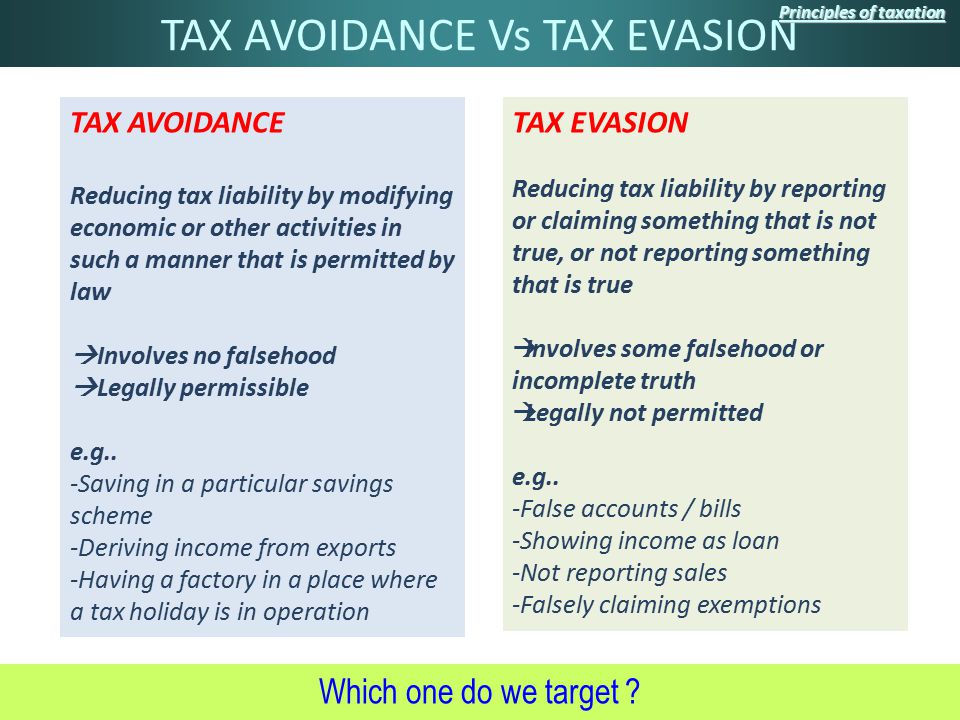

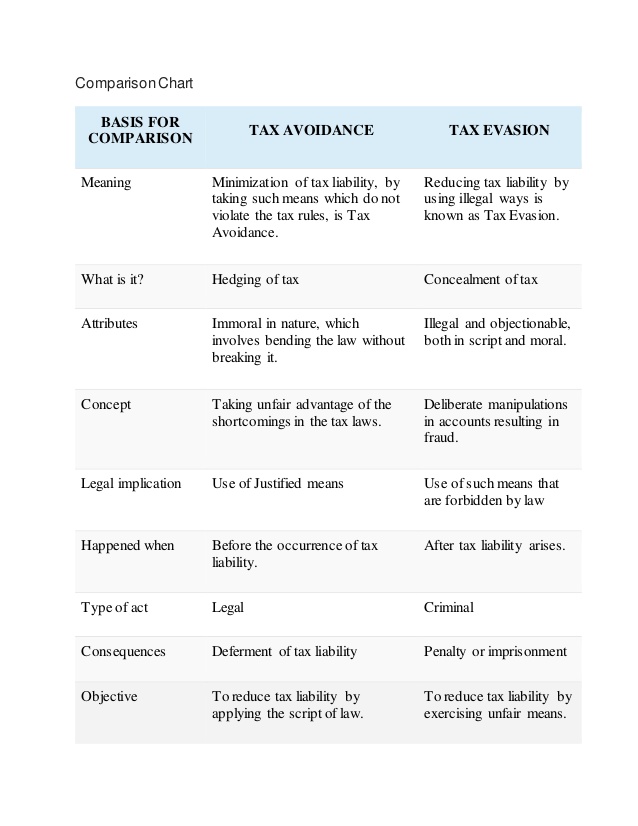

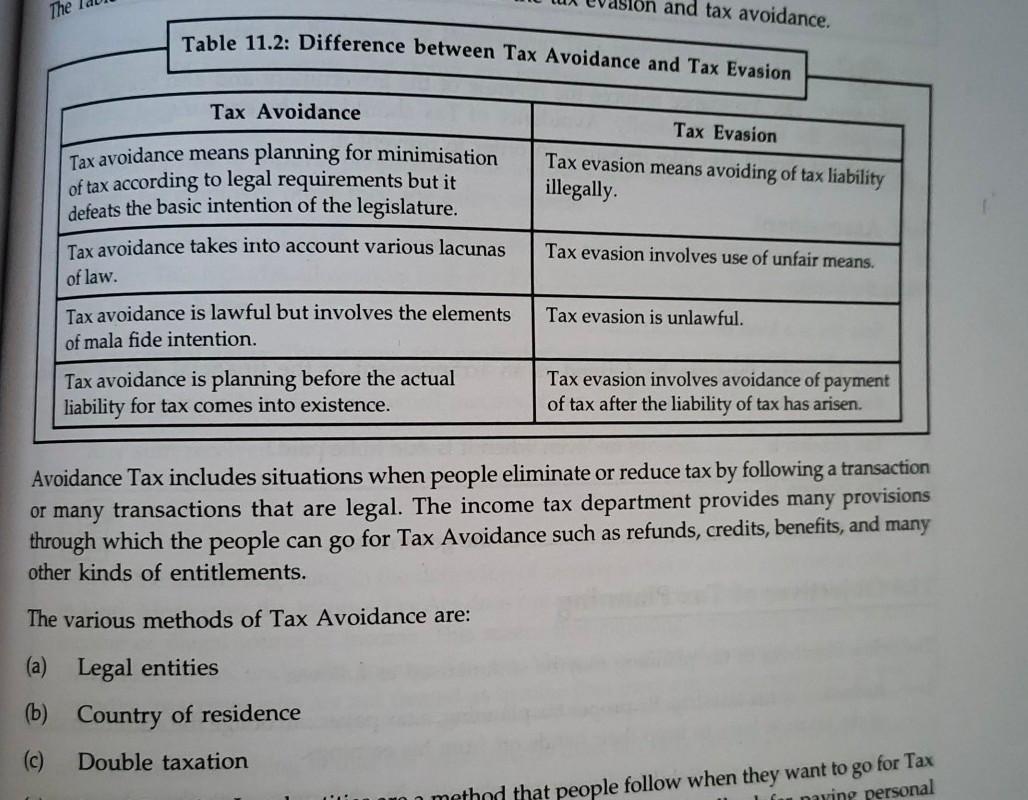

Walloping income from the tax department. The most noticeable difference between tax avoidance and tax evasion is legality. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer.

This could include travel. Examples of such ways are. Examples of tax evasion.

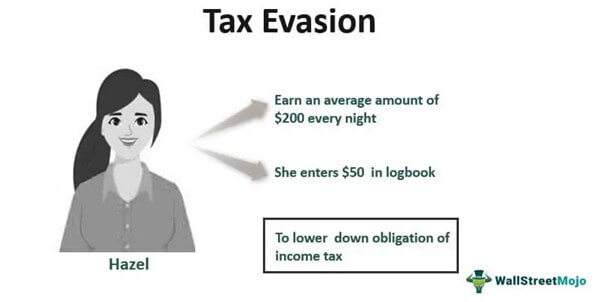

Tax evasion occurs when the taxpayer either evades assessment or evades payment. For instance the transfer of assets to prevent Uncle Sam from estimating their actual tax liability is an attempt to evade review. Having tax software opens in new tab can help you manage stuff like this legally.

You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401k plans. Keeping accurate and organized records E. The first one is the evasion of assessment which includes not informing tax authorities of your exact income.

1 Ignoring overseas income. Tax Evasion vs. Ignoring earnings for pet-sitting.

Tax avoidance is characterized as legal measures to utilize the tax system to discover approaches to pay the most reduced pace of tax eg placing reserve funds for the sake of your accomplice to benefit from their lower tax band. Is tax avoidance legal or illegal. Activity 1 Circle each example of tax evasion.

Mailing tax forms on time C. This occurs either when the taxpayer does not pay tax or bypasses assessment. Not reporting interest earned on loans C.

Claiming tax credits such as Work Opportunity tax credit. This is a serious violation of the IRS tax laws. Take note that tax evasion is a federal crime in the United States.

Employers should report income to the IRS by paying payroll taxes on their employees. This is one of the most common tax evasion examples. This often affects people with rental properties overseas.

Are you unsure of the difference between tax avoidance vs. For example paying someone under the table instead of providing them with a W-2 is considered tax evasion. Federal income tax than necessary because they misunderstand tax laws and fail to keep good records.

Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes. Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or. Tax evasion is the use of illegal means to avoid paying your taxes.

Often taxpayers can overlook their cryptocurrency holdings that have increased in value. Transferring money into 401K IRA or other accounts to delay tax till a later date. Claiming exemptions like home deduction.

Trust the Attorneys at the Law Offices of Kretzer and Volberding PC. A common form of tax evasion is not reporting the income you receive from others. Tax evasion could be Over claiming expenditures.

Here are some examples of tax evasion. In addition the tax. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law.

The other one is the evasion of payment. Definition and Examples.

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Liberal Dictionary

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Principles Of Taxation Ppt Download

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Tax Avoidance And Tax Evasion What Are The Differences